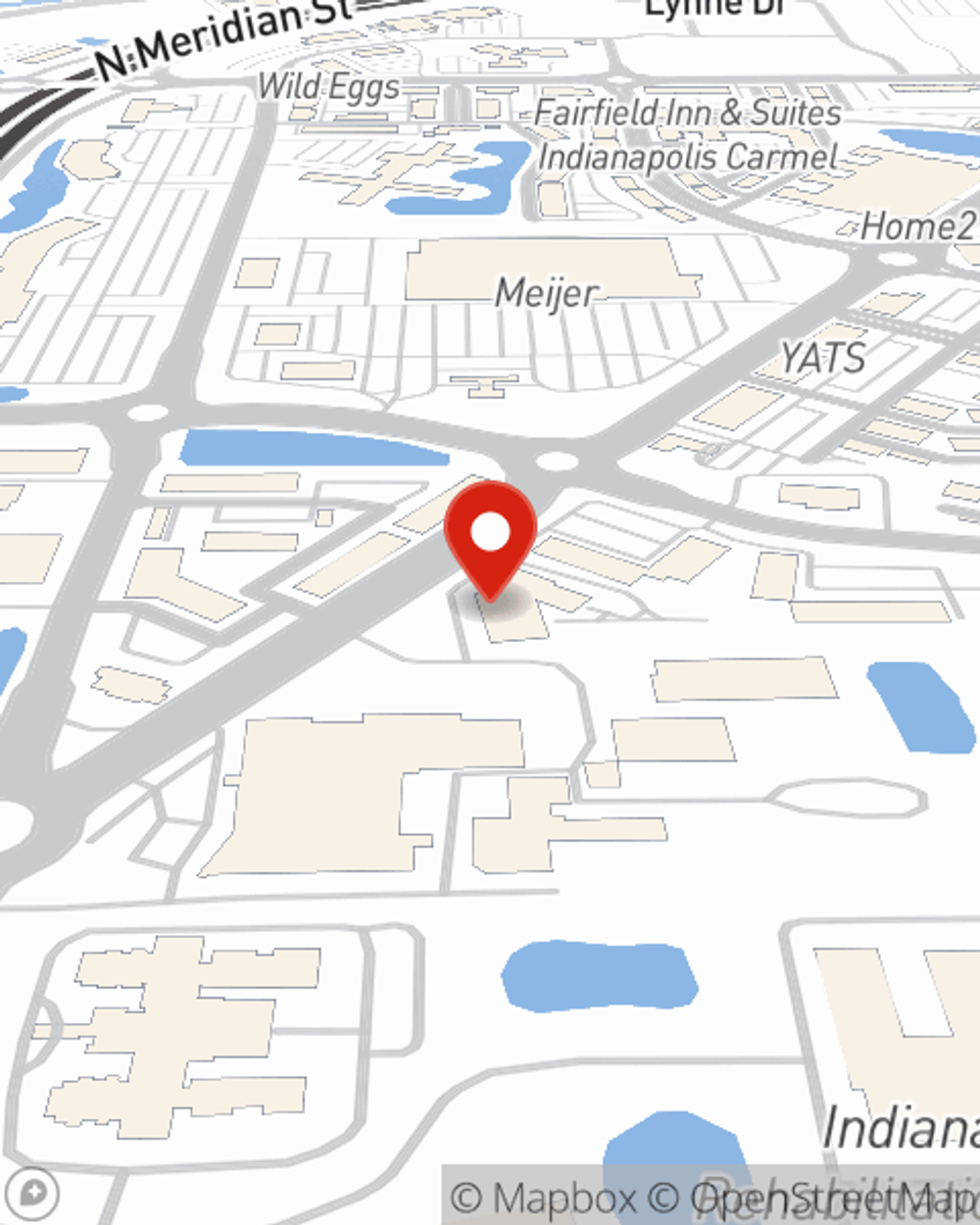

Renters Insurance in and around Carmel

Renters of Carmel, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Carmel, IN

- Hamilton County

- Cicero, IN

- Fisher, IN

- Westfield, IN

- Noblesville, IN

- Indianapolis, IN

- Zionsville, IN

- Indiana

- Anywhere Indiana

- McCordsville, IN

- Meridian Hills, IN

- Whitestown, IN

- Fortsville, IN

- Brownsburg, IN

- Clermont, IN

- Cumberland, IN

- Lawerence, IN

- Pendelton, IN

- Anderson, IN

- New Castle, IN

- Muncie, IN

- Lebanon, IN

- Crawfordsville, IN

Home Is Where Your Heart Is

Home is home even if you are leasing it. And whether it's a condo or a townhome, protection for your personal belongings is a good idea, even if you think you could afford to replace lost or damaged possessions.

Renters of Carmel, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Open The Door To Renters Insurance With State Farm

It's likely that your landlord's insurance only covers the structure of the property or condo you're renting. So, if you want to protect your valuables - such as a bedding set, a TV or a tablet - renters insurance is what you're looking for. State Farm agent Andrew Kennedy wants to help you examine your needs and keep your things safe.

Don’t let fears about protecting your personal belongings stress you out! Call or email State Farm Agent Andrew Kennedy today, and explore the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Andrew at (317) 844-2507 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Andrew Kennedy

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.